Challenges on the horizon as global supply continues to grow

Global supply

The 2022 global crop is forecast to be up 12% on the 2021 season, driven primarily by forecast increases in the South African and Chinese crops. This is despite Australia forecasting a 10% decrease compared with last season as a direct result of the severe weather and flooding in NSW and southeast Queensland. The revised Australian forecast is 49,340 tonnes in-shell @ 3.5% moisture (52,900 tonnes in-shell @ 10% moisture). This is still a realistic expectation given Australia’s largest producing region of Bundaberg is enjoying a very strong season. South Africa’s forecast for 2022 is 68,522 tonnes in-shell @ 3.5% moisture, a 22.2% increase on last season.

Global demand

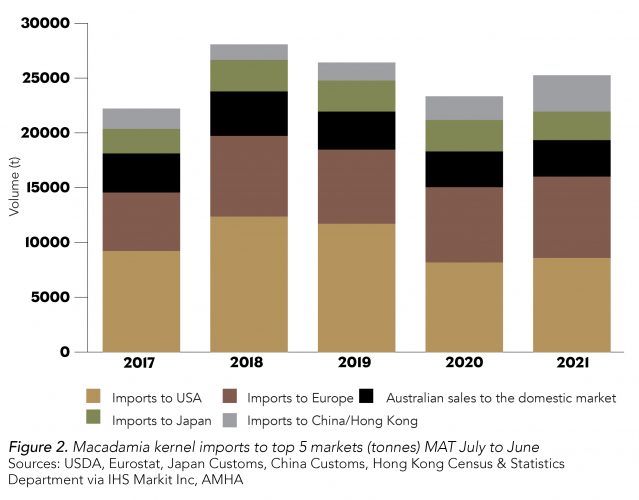

In the 12 months to June 2022, global macadamia kernel imports to the top five markets combined grew 8% on prior MAT period. All markets were in growth, except for Japan (-5%) and the domestic market (-4%). The major markets of Europe and USA were up +9% and +10% respectively. Total kernel imports to China/HK were recorded at a high of 3,900t, up 23%. Average price per kg data for imports indicates significant downward price pressures are continuing, particularly in the ingredient styles.

Total in-shell imports to China for the period MAT July to June were the highest on record for many years, being reported at 38,656 tonnes. China Customs data highlights the major importers of nut-in-shell are South Africa and Australia. Australian imports were at 13,685 tonnes (+15%) and South Africa imports at 14,084 tonnes (+94%) for this period.

Australian sales

Australian macadamia sales continue to increase year on year following Covid-19 disruptions. The industry recorded a strong 12 months for the MAT period (July to June) up 8% overall. The increase was driven by strong kernel sales to China/HK with increases also seen in Japan, Taiwan and Other Asia. Sales to the domestic, South Korean and Other Europe markets softened slightly, while Germany was stable.

Despite the upward sales trend, market conditions remain tough given the increase in supply, intensified price pressure in the ingredient market, and ongoing challenges with the supply chain.