The Australian macadamia industry is deeply committed to understanding what interests and motivates macadamia consumers in key markets globally. Central to maintaining this understanding is regular consumer insights research, and this year, we have been releasing the results of our largest quantitative consumer insights study to date.

Surveying more than 6,000 people in Australia, Japan, China, Taiwan, South Korea and the USA, this study examined not only current macadamia perceptions and consumption patterns, but also consumer sentiment around food and health more broadly.

Creating this broader lens through which to understand our consumer is invaluable in terms of better understanding how macadamias can cater to the needs and lifestyles of the people who currently consume our product, and where potential lies to reach a broader audience.

Here’s a snapshot of what macadamia consumers have on their minds when it comes to how they view food and health.

Diets: in or out?

Across all markets surveyed, people showed a keen interest in taking care of their health, but overall consumers felt that ‘eating healthy’ was more important than following a particular diet.

Australia and China had the most consumers following diets, both coming in at 48%. This was followed by Taiwan at 35%, USA at 26%, South Korea at 24%, and Japan at just 20%.

Plant-based was the most popular diet in China, Taiwan and South Korea. In Japan and USA it was keto, while in Australia, intermittent fasting dominates the diet scene.

While plant-based diets are popular in Asian markets, consumers feel limited by the products available. On the other hand, there are now so many vegan/plant-based products on the Australian and US markets that consumers feel overwhelmed.

What do consumers expect from food?

Consumers have both functional and emotional expectations of the food they eat.

In terms of functional benefits:

- Immunity support topped the list in Japan, China, South Korea and USA

- Fibre to support digestion and gut health was most popular in Australia

- Healthy fats to support heart health was the top response in Taiwan

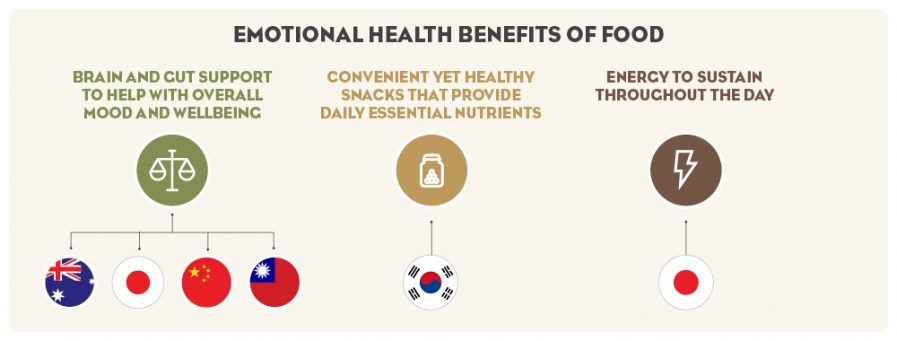

When it comes to emotional benefits:

- Food that offers brain and gut support to help with overall mood and wellbeing was the top response among Australian, Japanese, Chinese and Taiwanese consumers

- Convenient yet healthy snacks that provide essential nutrients was the most popular response in South Korea

- Energy to sustain throughout the day was Japan’s top answer

What does health look like in 2021?

Food is a key part of physical and mental health

Consumers now see physical and mental health as being equally important and something they can directly influence, particularly where food is involved. 60% of consumers globally believe we as individuals have the ability to not just manage our physical wellbeing, but also mental wellness.

Good food is deeply entrenched in the lives of consumers in all markets surveyed, with more than 50% saying that enjoying delicious food is a key part of their happiness and emotional wellbeing.

Almost half of all consumers value finding peace and quiet in everyday life over occasional big experiences and milestones as the key to a happy mind. Only 25% say occasional big experiences and milestones make them happy.

Eating well (74%) and sleeping well (67%) are universally seen as key to maintaining wellbeing. While exercise came in lower at 57% globally, this may have been impacted by the pandemic. Consumers in China and Taiwan appear to be exercising more, scoring 64% and 69% respectively for ‘staying physically fit’ as being a key to maintaining wellbeing.

Gut health

The link between food and good gut health appears to be well established in all markets.

- In Australia, Japan, China and South Korea, 60-65% of consumers identified food rather than supplements as being central to maintaining good gut health

- The USA was only slightly below this at 59%

- Taiwan showed the lowest awareness of this at 53%

Mental focus and concentration

When it comes to occasions that demand mental focus and concentration, office meetings topped the list in all markets.

Nuts were the second most common food consumers rely on to boost concentration and mental focus, behind tea/coffee. The exception to this was China, where nuts took top spot.

Embracing new opportunities

These insights are welcome news not only for the macadamia industry, but for manufacturers and brands considering the use of macadamias as an ingredient in new product formulations.

As a healthy and uniquely delicious plant-based whole food, macadamias are uniquely placed to meet many of the opportunities highlighted by the research.

To understand more about any of these insights and how they could support the use of macadamias in your product innovation plans, please contact Market Development Manager Jacqui Price.