2019 delivers sustained growth in macadamia demand

공급

The latest INC International data collection shows overall macadamia supply for 2019 was up slightly. Of the major producers, Australia was down 13%, South Africa was up 3%, Kenya and the USA were both flat, while Guatemala was up 12%. China reported an increase to 28,000 t however many reports suggest a result closer to 15,000–19,000 t, which would make total supply flat or slightly down on 2018.

At the time of writing there are no formal forecasts for 2020, however crop increases are anticipated in South Africa, Kenya and Hawaii. Australia’s crop is likely to be affected by the extended dry conditions during 2019, however it is too soon to predict whether the impact will be significant. Overall expectations are for macadamia supply to increase slightly in 2020.

수요

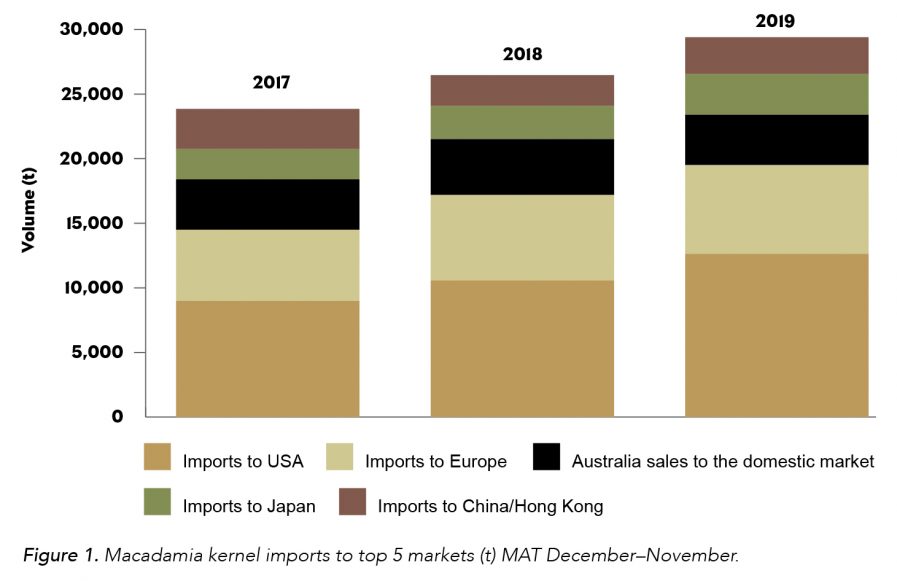

Overall demand for macadamias continued to rise in the 12 months to November 2019. Imports/sales to the top 5 kernel markets were up 11% (26,466 t to 29,396 t), and China/Hong Kong in-shell imports rose 25% (30,796 t to 38,560 t) over the same period.

On a year-to-date (YTD) basis (reflecting the crop season and in line with supply), overall kernel demand from these markets flattened out (15,293 t to 15,420 t), however in-shell imports rose 22% (20,531 t to 28,724 t), with reports that macadamias completely sold out during Singles Day in China in November.

호주 마카다미아 판매량

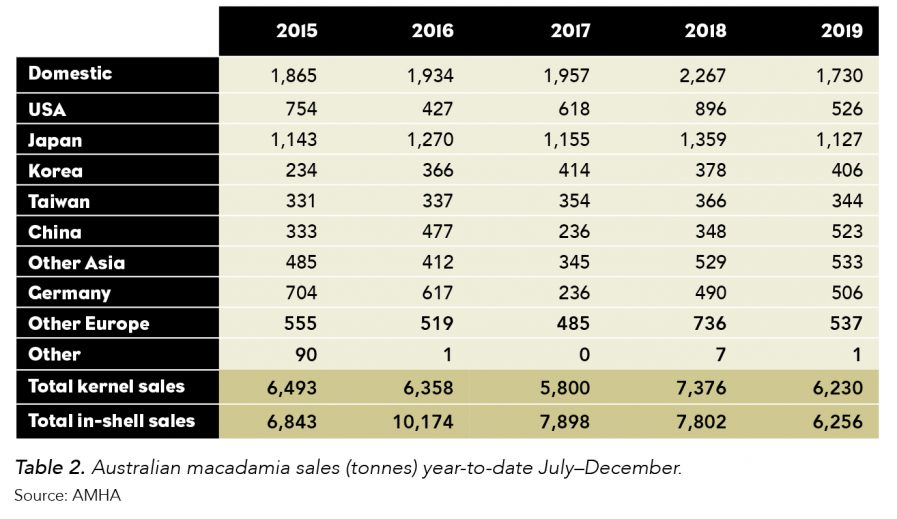

Total Australian kernel sales were steady in the 12 months to December 2019. Domestic sales declined but were still the second highest volume of the last 10 years. In-shell sales were down 29% in line with an industry-wide move to supporting the kernel market.

In the YTD period the impact of the lower 2019 crop was apparent across the board, with total kernel sales falling by 16% (7,376 t in 2018 down to 6,230 t in 2019).

글로벌 제품 혁신

Total new product launches using macadamias as an ingredient fell slightly in 2019. The snacking and confectionery categories represented the majority of new product development using macadamias as an ingredient at 40% and 18% respectively, and there was a slight lift in the average number of countries launching new products with macadamias last year.